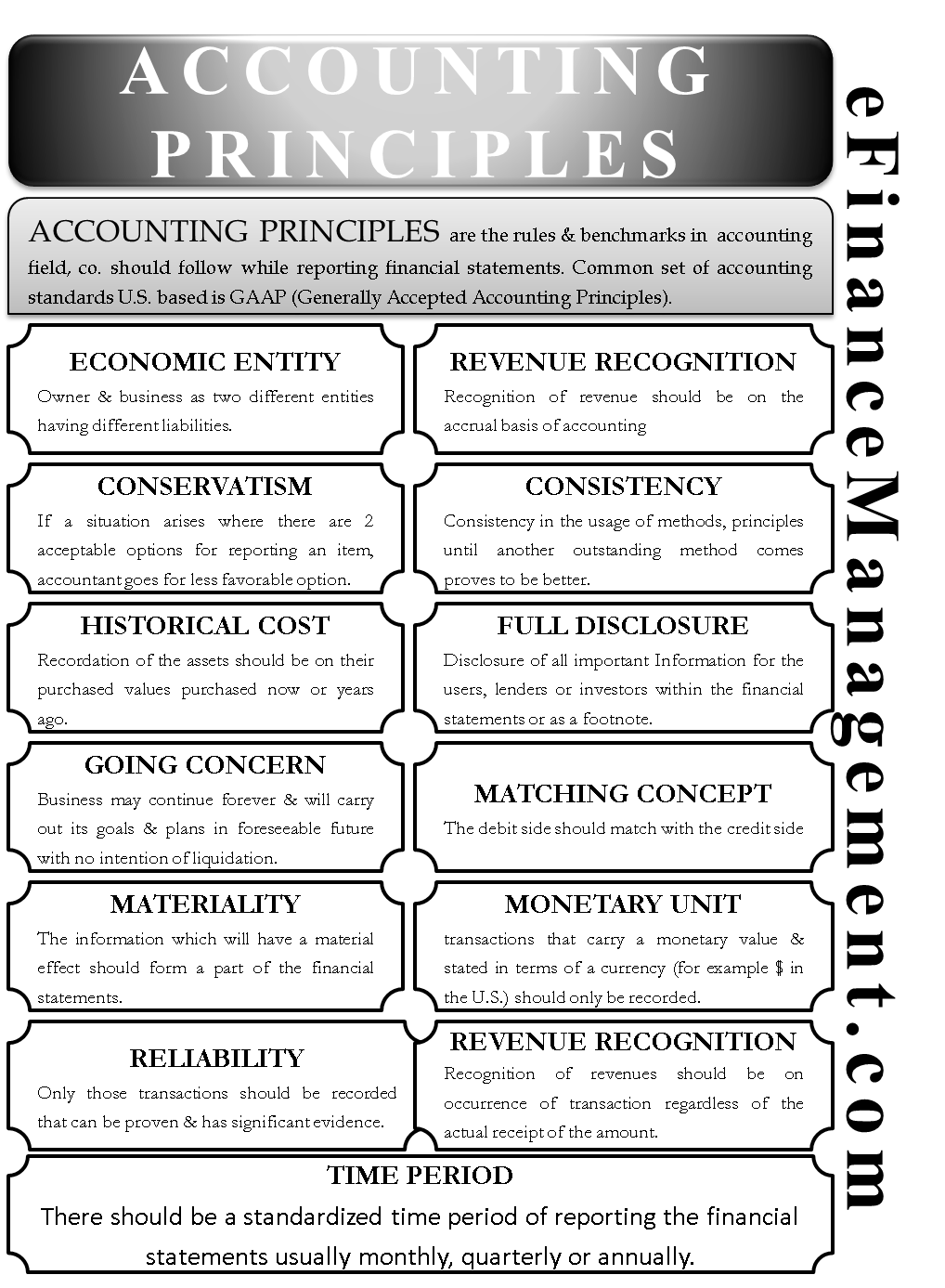

Such an accounting methodology makes it possible to accumulate all information pertaining to revenue and expenses for a specified accounting period, without having to factor in the actual cash flows associated with the revenue and expenses during that accounting period. In simpler terms, accrual accounting only considers the time when the transaction takes place, rather than the time in which the actual cash payment is made or received. It is employed by most companies (except small-cap companies that employ cash basis accounting methods) in order to prepare financial statements.īack to: Accounting & Taxation How does the Accrual Principle Work?Īccording to the accrual principle, the performance and position of a company should be measured by recording economic events, regardless of the time of occurrence of actual cash flows. The accrual principle is formally required by accounting frameworks across the globe, such as the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS). The accrual principle, also known as the accrual concept, is a concept used in accounting that mandates the recording of accounting transactions in the actual period of occurrence, rather than the period of occurrence of related cash flows. Cash Accounting Academic Research for Accrual Principle What is the Accrual Principle? These policies and methods must be disclosed to the users of financial statements.Update Table of Contents What is the Accrual Principle? How does the Accrual Principle Work? The Process of Recording Transactions under the Accrual Principle Accrual Accounting vs. Every company uses certain accounting policies and methods for preparing its financial statements.If a company expects a change in tax rate in near future, it must disclose this information in some appropriate manner.

current ratio) that depict the company’s capacity to pay its liabilities as they fall due, all the information mentioned above will help the bank decide whether the company meets the requirements of the covenants and based on that information the bank can decide whether it should renew the loan or not. Like, for instance, if a bank has related covenants to meet certain liquidity ratios (e.g. could help external users to make more informed decision. Along with the values, the rate of depreciation, the policy of charging depreciation or amortization, the policies about revaluations of assets, any liabilities or provisions that are contingent, any assets that fall under fixed or floating charge, any assets leased, physical condition of the building and machinery etc. Another example could be the knowledge about the assets and liabilities of a company.

So in the light of this data any new possible investors can make their decision about investing in the company with more ease.

#Principal definition accounting full#

The full disclosure principle will require the managers of the company to disclose all the information related to that loan arrangement like loan deed itself, the duration of loan, any collateral liability attached and the rate of interest the company is charging to that director etc. If we talk about a loan to a director provided by the company.Due to lack of insight about the company’s internal affairs, these statements are vital piece of information for outsiders and full disclosure principle serves as a savior for them. Thus, full disclosure principle of accounting emphasizes that any piece of data that could materially alter the opinion or decision of these users must be included in entity’s financial statements. These external stakeholders analyze and interpret these financial statements to make informed and detailed decisions. also use these financial statements to feed their individual information needs. Stakeholders like suppliers, customers, lenders, potential investors etc. But it is also a fact that shareholders are not the only party of interest that relies on these financial statements. This allows them to look after the activities of management and to make sure that their company is running profitably. The financial statements of a company are primarily prepared for the use of shareholders of that company. Such information is made available to stockholders and other users either on the face of financial statements or in the notes to the financial statements. According to this principal, the management of an entity is required to disclose all the relevant and appropriate information (both financial and non-financial) in their financial statements that could impact the decision making behavior of the users of those statements. The full disclosure principle of accounting is related to materiality concept of accounting and talks about the information disclosure requirements for the users of financial statements of an entity.

0 kommentar(er)

0 kommentar(er)